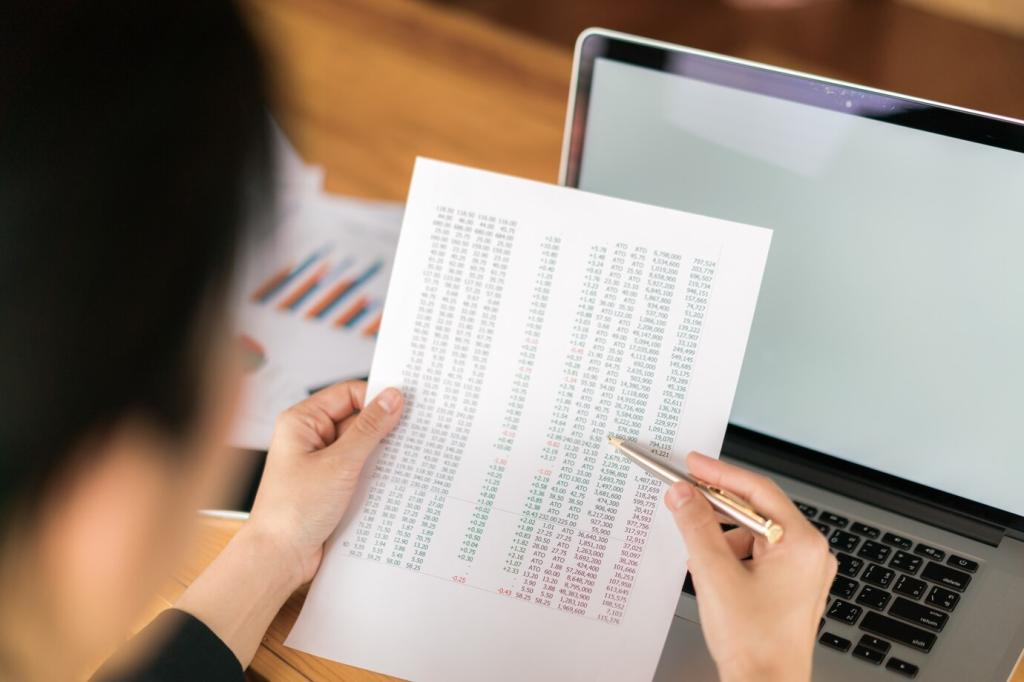

Build a Simple 50/30/20 Starter Budget

Needs include rent, basic groceries, utilities, essential transport, and minimum debt payments. Be honest about what truly belongs here. If your needs exceed fifty percent, flag it for future adjustments. Comment with one need you can trim slightly, and we’ll share gentle ideas to start.

Build a Simple 50/30/20 Starter Budget

Wants cover dining out, subscriptions, entertainment, and upgrades. Beginners often overspend here unknowingly. Cap wants at thirty percent, and create a fun-money allowance to keep joy intact. Tell us your favorite low-cost treat so the community can build a shared list of affordable delights.